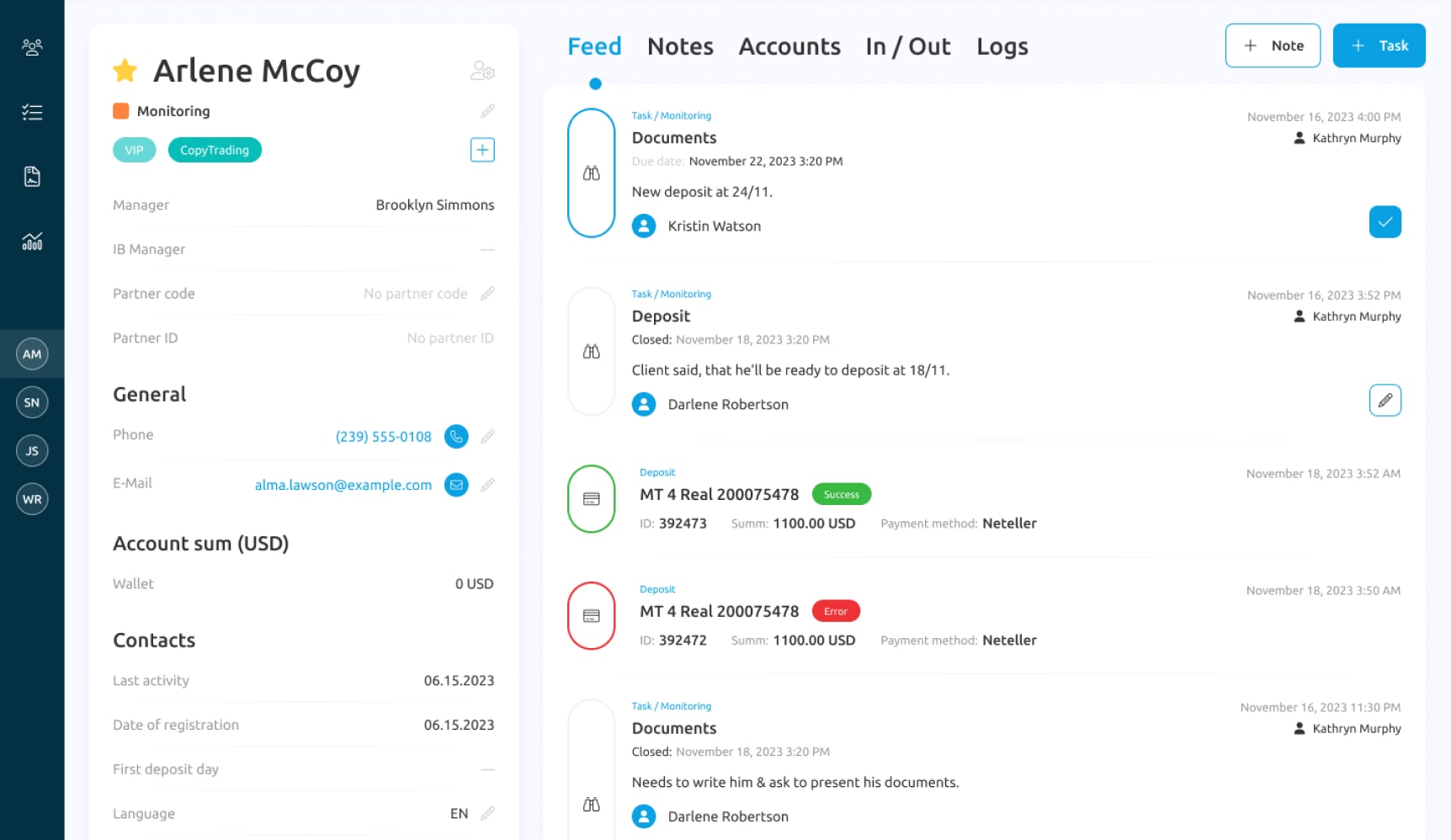

Customer profile

Sales managers benefit from streamlined operations with features like quick calls, allowing for rapid communication without the need for opening separate pages.

It also contains detailed feed, notes, account's information and logs.