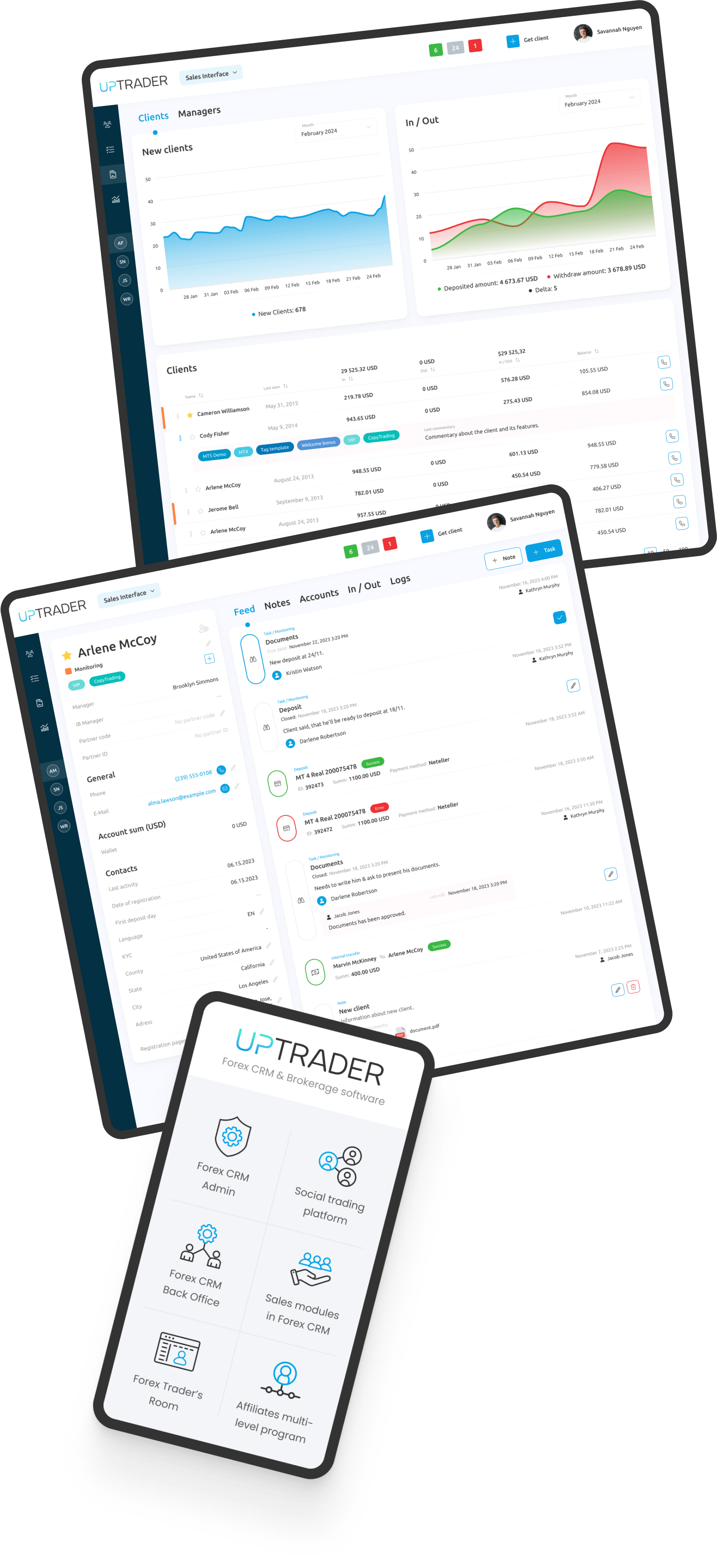

Get New Sales Interface

For brokers looking to skyrocket their sales.

- Quick Calls and Planned Deposits System

- Sales Percentage Encouragement System

- Sales Department Analysis

- Flagging Promising Leads

Our new Sales Interface is coming soon. But don't delay! You can now to secure a prime spot on our integration list.